The Free Market Center

The Free Market Center

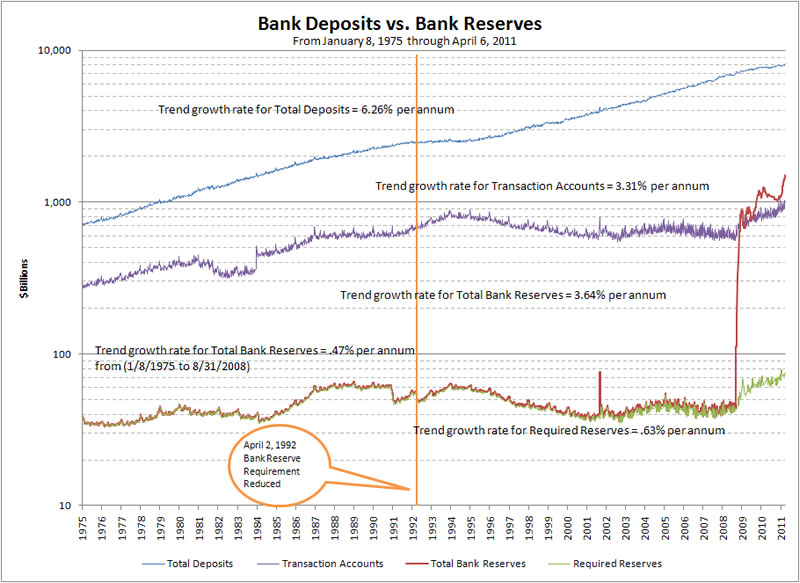

This chart provides evidence of what I contend amounted to a major shift in the structure of the American banking system. In April of 1992 The Federal Reserve made the last of of a series of reductions in the reserve requirements on both demand and time deposits (a.k.a. transaction accounts and nontransaction accounts respectively). Shortly after that time the quantity of demand deposits and, not coincidentally, the amount of bank reserves essentially flattened out (during some periods they actually declined.) The amount of total deposits, however, continued to grow significantly.

In a banking system in which the distinction between demand and time deposits had been virtually lost (because of the advent of money market funds and vehicles for transferring time money to demand accounts), The Federal Reserve had reduced its influence on the growth of money to near zero. Banks could create money nearly at will, so long as they had the bank capital to support the assets purchased.

Notice, on this chart, how the growth of transaction accounts and total bank reserves flattened out after 1992 (the vertical orange line). In fact, although the transaction accounts and total bank reserves increased for about two years after this point, they actually declined during the period from roughly 1994 to 2008.

For most of the period depicted in this chart, 1975 to August of 2008, total bank reserves grew at a rate of roughly 0.5% per annum while total deposits grew at a rate of more than 6% per annum. The evidence seems fairly conclusive that The Federal Reserve, during this period, did not promote monetary expansion through its open market operations, but it did facilitate that monetary growth as a result of changes in required reserves.

Many people argue that Chairman Alan Greenspan, through The Federal Reserve's open market operations, caused the monetary expansion that led to the real estate collapse in 2008. The evidence suggests that, rather than open market operations, Greenspan's biggest contribution to the problems in the real estate and mortgage market consisted of the two reductions in reserve requirements in 1990 and 1992. These reductions in reserve requirements gave the banking system free reign to create the money that led to the collapse.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: