The Free Market Center

The Free Market Center

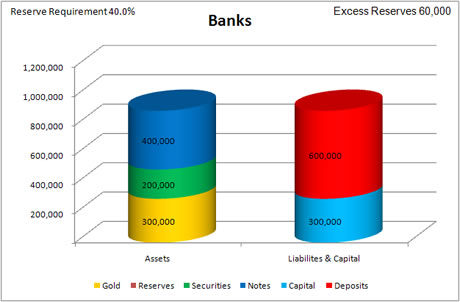

On this page we see the beginning of money creation by The Banks in The New Fantasy Banking System. Notice: No Fed involved.

The Banks acquire 400,000 M-oz. of notes (see the blue on the chart) from people we normally call "borrowers." Those notes (liabilities from the customers to The Banks) represent assets for The Banks. The Banks pay for these notes by giving the "borrowers" their promise to pay in the form of deposit liabilities. Notice: The increase in Deposits.

| Assets | Liabilities & Capital |

|---|---|

Increase Notes by |

Increase Deposit Liabilities by 400,000 M-oz. |

| Assets | Liabilities & Capital |

|---|---|

Gold bars. Old style money. (Works pretty good with no central bank.) |

By paying for these notes with bank liabilities, The Banks have created a form of new money—i.e. a claim on gold, a money good. The deposit account holders can spend this money by writing checks against those claims. The system now has 400,000 M-oz. more money than before the transaction.

Notice that The Banks now have more deposit liabilities than they have gold—the only form of bank reserves at this time. In addition, based on the currently accepted 40% reserve requirement, The Banks only need to have 240,000 M-oz. of reserves (gold). Thus, they have 60,000 M-oz. in excess reserves, which would permit them to increase deposit liabilities (i.e. money) by another 150,000 M-oz. (60,000 M-oz. in excess reserves divided by 40% reserve requirement = 150,000 M-oz. potential new deposits).

So far we have seen how banks create new money without the involvement of any central bank. The secret, as many of you know, lies in the practice of fractional reserve banking.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: