The Free Market Center

The Free Market Center

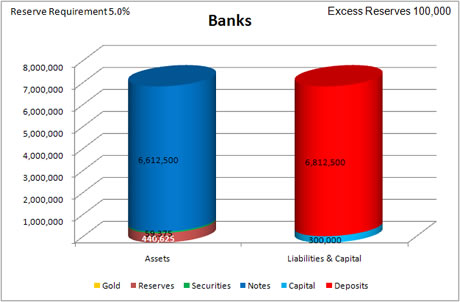

Finally, consumers and businesses decide they want some of the money that The Banks have the capability to create. And The Banks happily accommodate.

The Banks buy 6,000,000 M-oz. of notes from borrowers. They also increase their deposit liabilities by 6,000,000 M-oz. as payment for these notes.

| Assets | Liabilities & Capital |

|---|---|

| Increase Notes by 6,000,000 M-oz. | Increase Deposit Liabilities by 6,000,000 M-oz. |

| Assets | Liabilities & Capital |

|---|---|

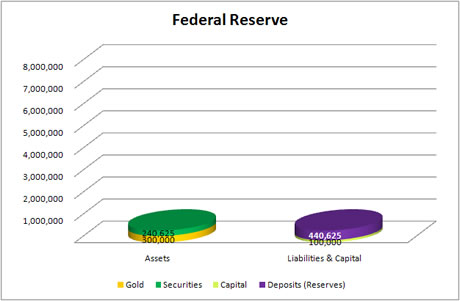

| No effect on Fed's accounts. |

Notice the change in scale in the charts.

In response to the new capacity provided for them, The Banks started buying all the notes offered to them. They bought an additional 6,000,000 M-oz. in notes (or made 6,000,000 M-oz. in loans) and increased the quantity of money by another 6,000,000 M-oz. And they still have 100,000 R-oz. in excess reserves.

The last three periods demonstrate the separation of the actions of The Fed from the money creating actions of The Banks.

But, so far I have only shown transactions between The Banks and The Fed.…

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: