The Free Market Center

“Money interest rates determine the supply of money.” and “Interest rates indicate whether fed is too tight or loose.”

Interest rates, like all prices, are dependent variables. The relative demand for present money vs. future money by market actors determines interest rates. Historical interest rates influence the expectations of actors, but they do not determine rates.

Some evidence:

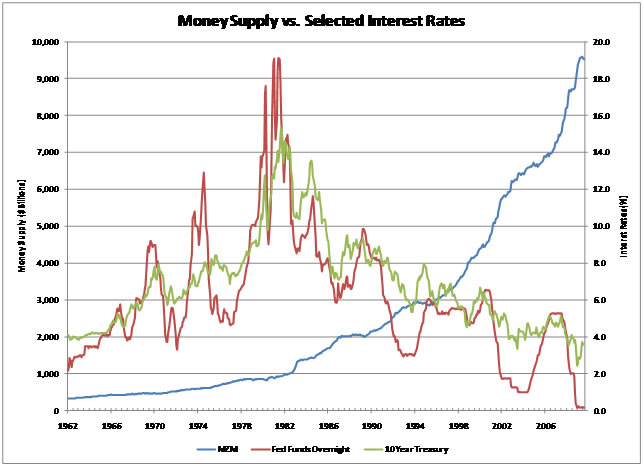

This chart shows the money supply (MZM) vs. a couple of selected interests: the wildly popular fed funds rate and the 10 year Treasury rate. Correlation? What correlation?

Or

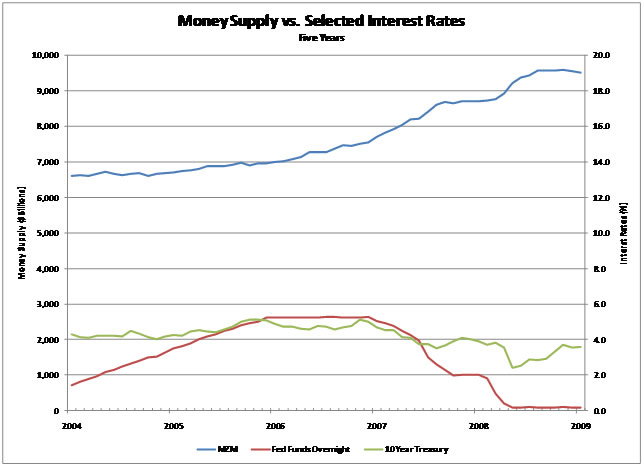

Let’s shift the focus up close. How ‘bout 5 years.

If low rates caused the increase in money over the last year and a half, what did they do before that?

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: