The Free Market Center

"Money supply is determined entirely by the Federal Reserve."

The actions of the all players within the monetary system determine the supply of money. Banks play the most important role. In our system, only banks have the ability to create money at will.

In spite of its significant influence on the money supply, the Fed cannot force the increase or decrease in the supply of money. Banks must provide credit (deposits) in exchange for assets for the creation of new money. Now, because of the ZERO reserve requirement on time deposits and deposit shifting by banks, the Fed has much less influence than it has historically.

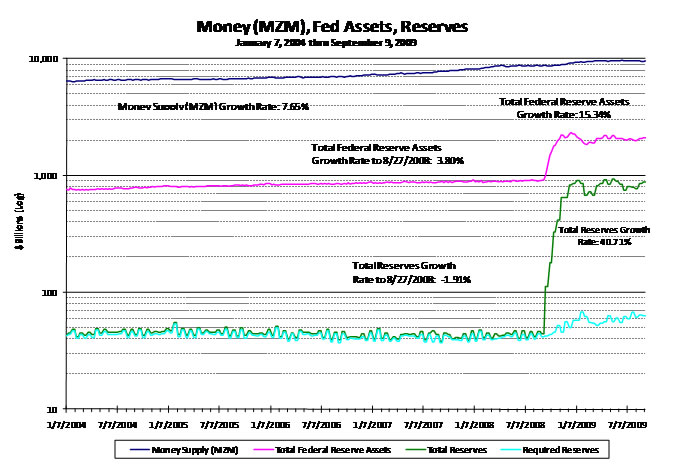

The following chart gives some evidence of this point:

From 2004 through most of 2008 the money supply and bank deposits grew while bank reserves actually declined. Since September of 2008 bank reserves while the money supply and bank deposits have flattened out.

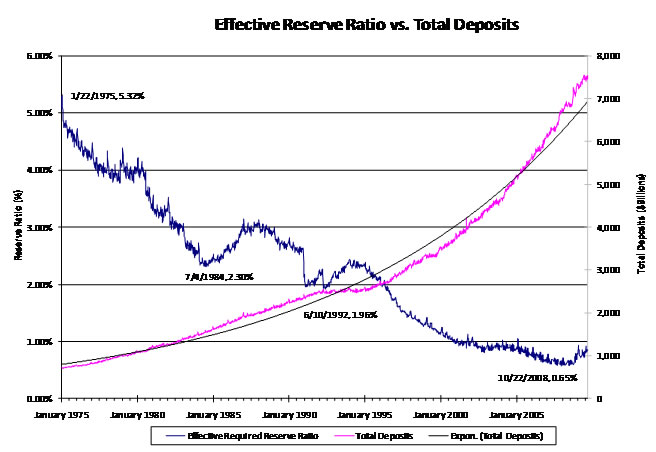

This next chart provides a somewhat different perspective on the same phenomenon:

This chart demonstrates how, since 1975, the money supply (MZM) has grown steadily, while the effective required reserve ratio has decline from 5.3% to 0.65%. (effective required reserve ratio = actual bank reserves/Total Deposits)

This distinction takes on considerable significance when looking for a solution to monetary expansion, malinvestment, and economic busts.

To view a detailed description of how banks create money go here.

© 2010—2020 The Free Market Center & James B. Berger. All rights reserved.

To contact Jim Berger, e-mail: